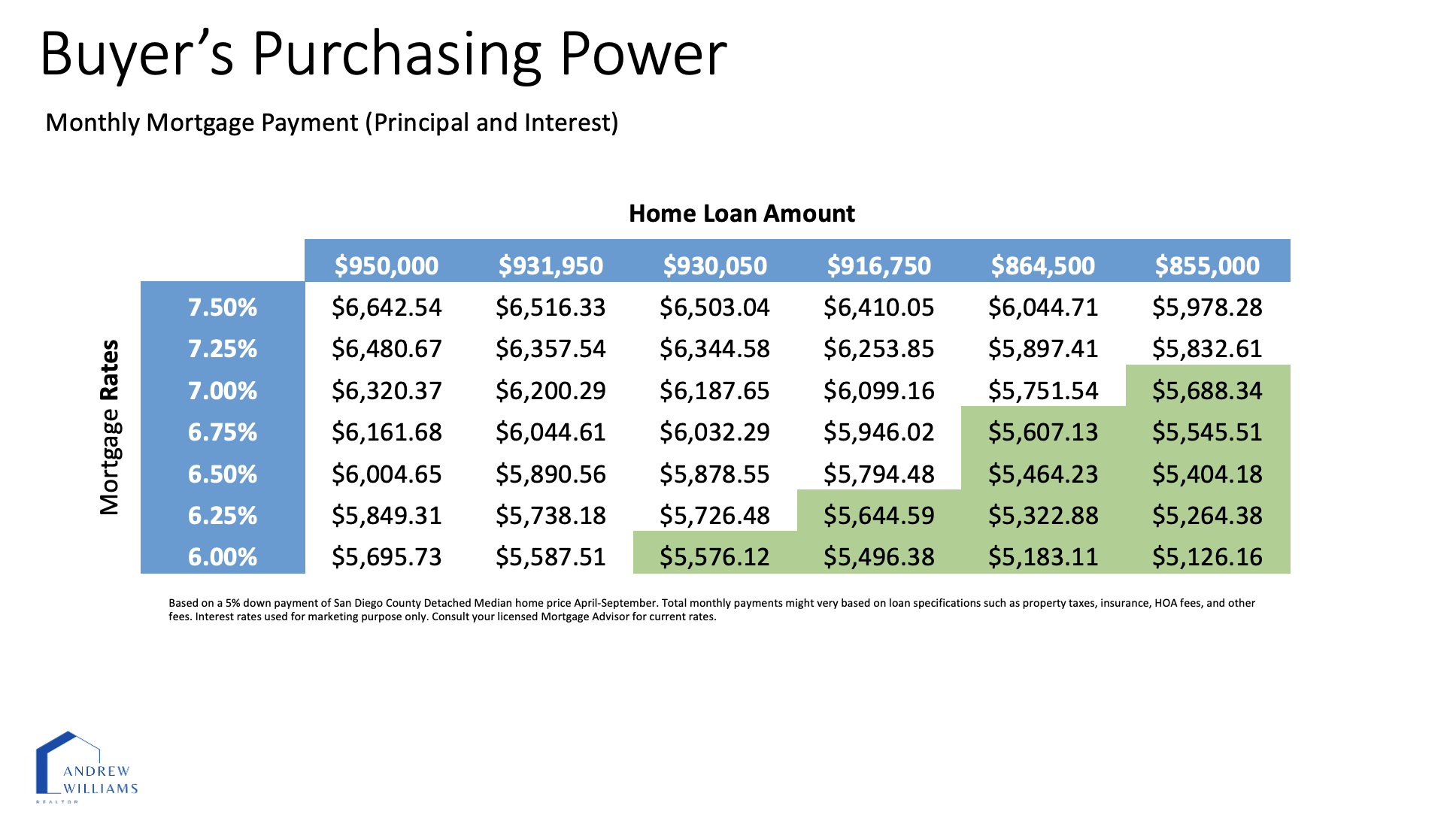

Increasing Mortgage Rates

Mortgage rates have increased significantly over the past month from 5.66% to 6.6%. It seems like buyers just can’t catch a break. Just as prices have begun to slow interest rates shot up, now approaching 7% and will likely slow buyer demand as buyers are having to pay more per month on their monthly mortgages. Be sure to check will your local mortgage broker as they may be able to offer you better rates.

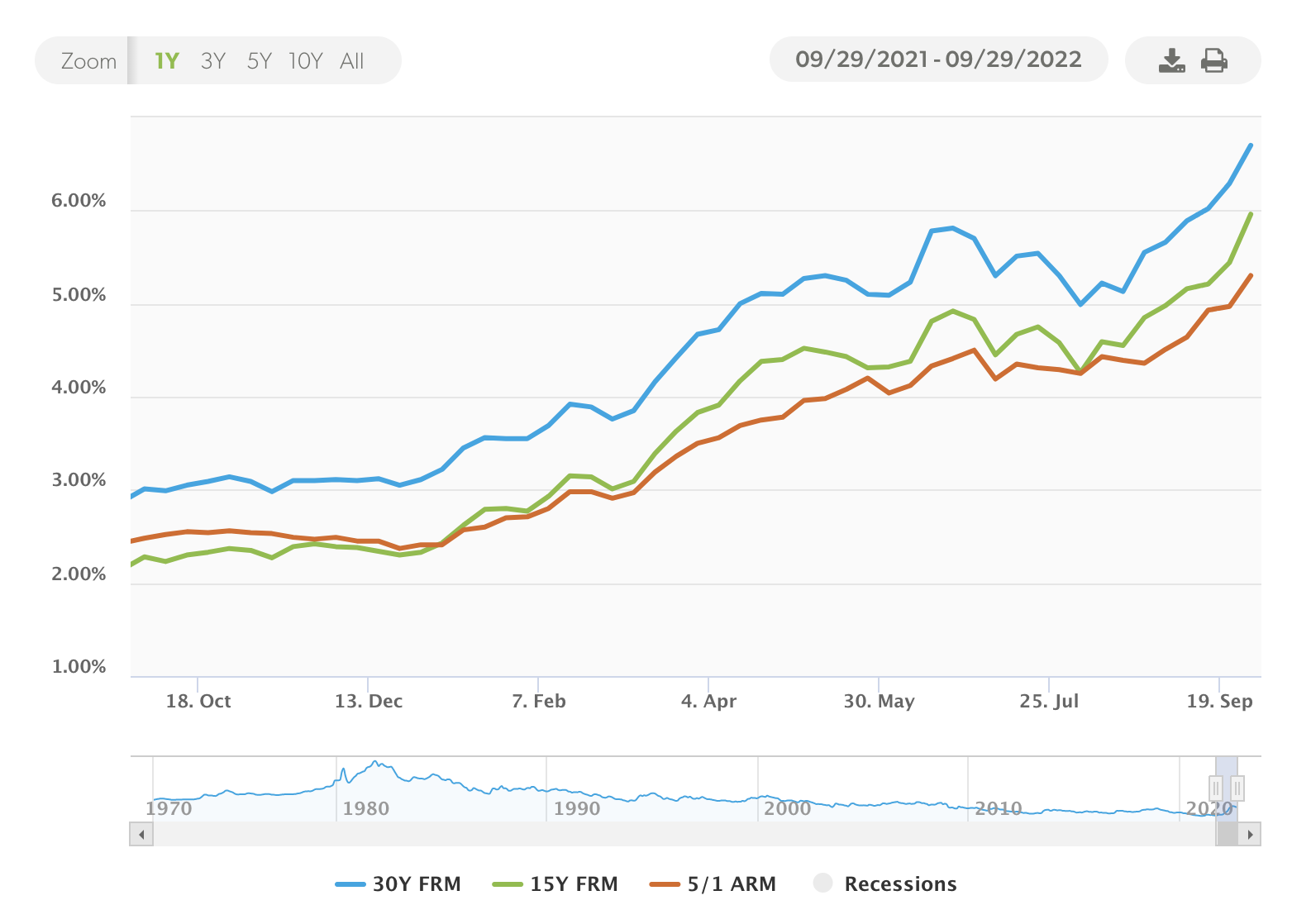

Impact on Buying Power

As rates rise sharply, so will your monthly mortgage payments and the amount of house you can comfortably afford. This could potential have you now looking at homes a different price bracket as rates rise. Let’s say you wanted to keep your monthly payment at $5,700 or below. The chart below shows how your purchasing power changes as rates begin to rise. If you take a look at the chart the green shows payments within your monthly payment range. As rates raise you can see the affect on monthly mortgage payments and the amount of home you can comfortably afford.

Will Mortgage Rates Go Down

Should you step out of the market for a while and wait for rates to go down? Nobody has a crystal ball to see the future and where rates are going. But here’s what Realtor.com said about were rates could go:

“Many homebuyers likely winced on Wednesday upon hearing the Federal Reserve yet again boosted its short-term interest rates by three-quarters of a percentage point – a move that’s pushing mortgage rates through the roof. And the already high rates are just going to get higher”

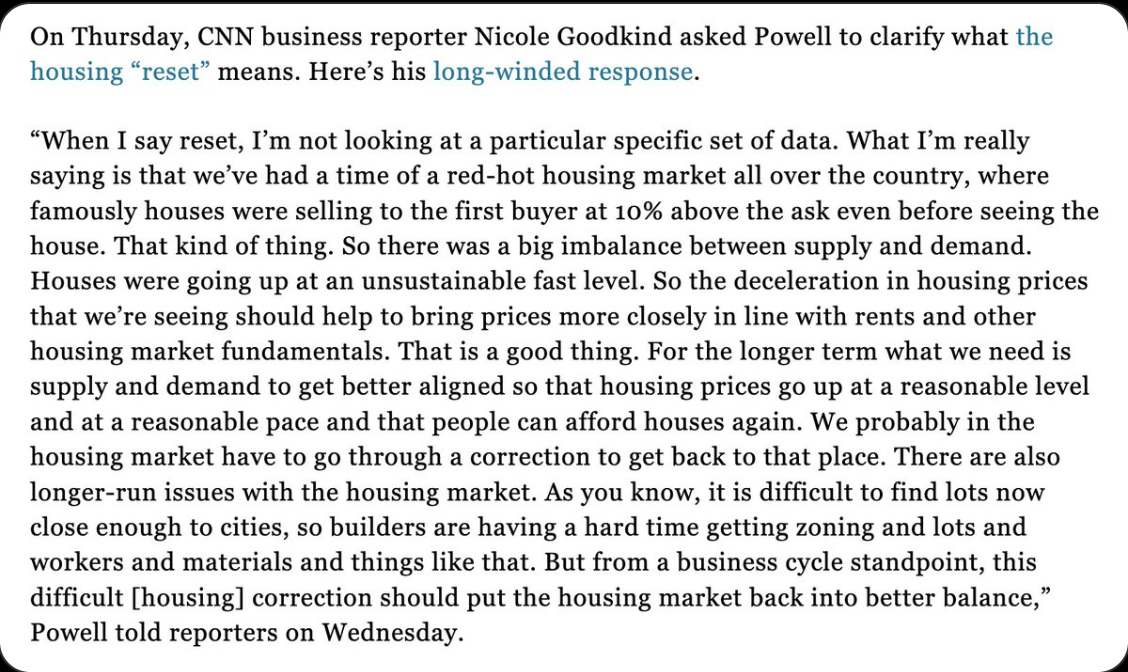

With the Fed is trying to get inflation under control, we might want to start listening to what Jerome Powell said about wanting a housing reset. Below is a quote by Jerome Powell posted by Lance Lambert on his twitter account.

How This Impacts You

There’s no way to sugar coat this, as rates rise it’s going to raise the cost of buying a home. If you feel you’re in a place financially to buy a home, you probably don’t want to wait. Additionally, if you lock in your rate now and rates go up, great you got a better rate. If rates drop below your current rate, you can always choose to refinance down the road. But today buyers are in a better place than a year ago. More homes are now available to choose from and you can even get seller credits to help with closing cost or buy down the interest rate.

I’d love to help you achieve your real estate goals, let’s connect if there’s any way I can help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link